The Future of Vertical Software - Bright or Dim?

As AGI gets nearer and LLMs continue to scale, where will vertical software play in the world of AI? Exploring potential outcomes.

In June of 2024, Thrive Capital Partner and co-founder of Pace Capital Chris Paik released a one page essay titled “The End of Software” in which he compares the looming threat of LLMs to today’s software industry to the disruption the internet brought to traditional media in the early 2000s.

Paik draws a powerful analogy: Just as the internet reduced the cost of content creation and distribution to near zero, LLMs will drive the cost of software creation to near zero. He argues that the shift will fundamentally change the economics of software and the businesses built around it.

Paik states that if AI can generate, deploy, and maintain software autonomously, then software no longer needs to make money to exist—just like internet content. Additionally, Bessemer Venture Partners contends the same viewpoint, stating in its 2024 State of the Cloud that:

“By the end of the decade, significant developer capability will be available to every human with a computer.”

This widespread availability will trigger a Cambrian explosion of software, as AI-driven tools unlock an abundance of solutions tailored to niche problems, many of which will serve intents and pain points that monolithic SaaS platforms like Salesforce address today.

This essay implies that vertical software, especially point solutions, are not in the best shape when we look forward to how AI will change the business landscape.

Paik’s essay sharply contrasts the sentiment of many other AI future prospectors, including that of Kevin Zhang at East Wind, who writes that since vertical software companies can create specific solutions for industries, highly technical founders who have domain expertise will be able to succeed in creating vertical software that dominates markets and cuts jobs.

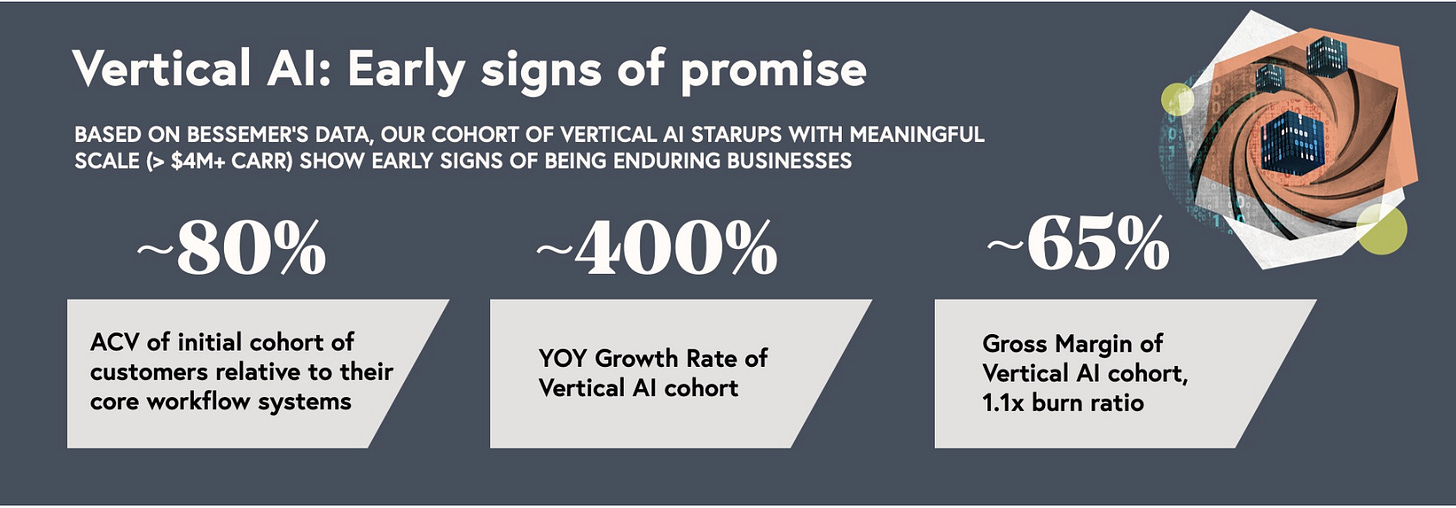

Additionally, Bessemer writes that Vertical AI shows immense promise in creating entirely new business models, targeting high-cost, repetitive, language-based tasks that dominate significant sectors of the economy. While legacy vertical SaaS companies transformed industries during the first cloud revolution, Vertical AI unlocks opportunities where labor was traditionally too expensive, inconsistent, or insufficient. This represents a fundamentally different opportunity size compared to legacy software: instead of automating specific workflows, AI-native applications replace service-heavy labor markets altogether.

Thus lies the tension:

Some think like Paik that AI will replace software’s economic moats, leading to a "Cambrian explosion" of AI-generated tools that dynamically solve niche problems in niche industries. This would presumably erode away the value of vertical SaaS platforms, especially point-solution based platforms that are meant to relieve a common problem that is industry-specific. Like traditional media companies facing free, user-generated content, software companies relying on human-built, expensive solutions will lose value to AI-driven micro-apps. Why pay for a software when it takes a day to build it yourself?

Other’s contend views more similar to that of Zhang and Bessemer. Vertical software remains defensible due to its necessity of a highly specialized and technical founder and large TAM.

So, what does vertical software look like in the AI era?

This question has riddled my brain for the past couple of days, and I’m not sure I can give a definitive response. However, what I can say is that the difference between surviving vertical platforms and ones washed away by the Cambrian explosion relies on one main trait solely. Data.

Data as a moat.

One of the best case studies of vertical AI comes from CCC Intelligent Solutions (NYSE: CCCS), a leading software provider in the property and casualty (P&C) insurance sector, particularly focused on automotive claims and repair solutions. Established in 1980, CCC processes more than $100 billion in claims annually, connecting 18 of the top 20 P&C insurers, over 28,000 repair shops, and a wide network of OEMs and dealerships. This ecosystem positions CCC as the industry benchmark.

CCC’s latest product, Estimate Straight Through Processing (Estimate-STP), highlights the power of AI-driven vertical software. Estimate-STP leverages AI models to process insurance claims with line-level detail in seconds—far outpacing human adjusters, who average only 5-6 claims per day. Early adoption of the software is promising, with (according to the company) most insurance providers already processing 3% of claims through it, and leading adopters reaching as high as 20%.

The key to Estimate-STP’s success lies in CCC’s unparalleled market dominance and access to proprietary data. Holding a 75% market share in auto insurance data, CCC has amassed a vast, high-quality dataset comprising millions of claims, which it uses to train its AI models. This data advantage is analogous to Tesla’s dominance in training its Full Self-Driving (FSD) neural network, thanks to its extensive driving data. The sheer volume and exclusivity of this data create an insurmountable moat for CCC, enabling it to develop AI solutions far superior to competitors relying on limited or synthetic data. I highly doubt anyone will be able to create a competitive estimation software with as much precision as CCC.

I tend to believe that companies like CCC and Veeva Systems will benefit from data-created moats as AI grows more intelligent. As data is the new oil, their products will simply be more accurate

Past Data, is there a Moat?

The defensibility of vertical software in an AI-driven world hinges on whether its foundational value—primarily derived from specialized knowledge and proprietary datasets—remains intact as AI lowers the barriers to entry. The historical performance of vertical AI solutions, like CCC Intelligent Solutions’ Estimate-STP, suggests that companies with unique and extensive datasets have significant staying power. However, the broader landscape of vertical software startups paints a more uncertain picture.

The real risk for vertical AI isn’t immediate competition from rival startups but rather a shift in buyer behavior. As AI tools become increasingly accessible, companies may no longer need to rely on external software providers. Instead, they might develop bespoke solutions in-house, tailored to their unique needs, bypassing subscription-based vertical platforms altogether.

Bessemer's numbers on vertical AI likely reflect an antebellum period, where companies are adopting AI tools to cut costs and improve workflows ahead of the full arrival of AI Agents and AGI. This phase marks a transition—businesses experiment with AI for incremental gains while bracing for a future where autonomous systems will redefine software development.

Case Study and Comparison: Outsourced Content Creation

When content creation tools like Canva and free editing platforms became widely available, the cost of design work dropped to near zero. This shift led many businesses to build internal marketing teams, leveraging these tools to create content in-house. At first glance, this raises a parallel question: Why wouldn’t companies hire a small team of AI developers to generate and maintain internal systems rather than paying recurring SaaS fees?

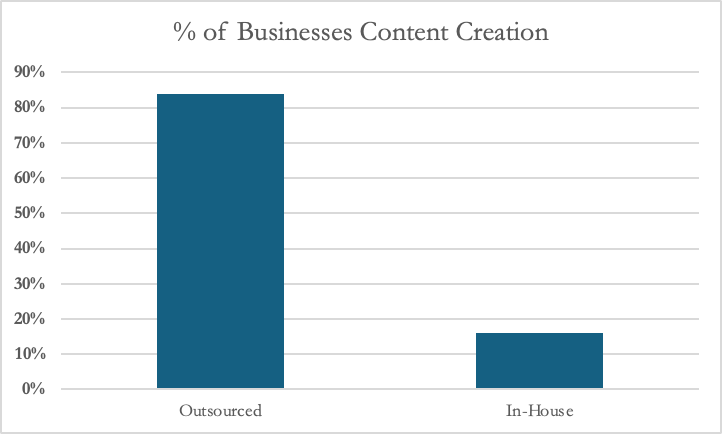

Yet, according to the New York Times, 84% of companies still outsource content production and development. Why? The reality is that the true cost of producing high-quality content is far from zero. Expertise, time, and economies of scale make outsourcing not only viable but often cheaper and more efficient than internalizing these functions.

The same pattern could emerge in AI software development. While AI tools democratize software creation, the complexity of building and maintaining robust systems may drive businesses to outsource instead. The rise of AI development agencies—firms specializing in creating and maintaining bespoke software solutions—could parallel the evolution of content agencies.

In Conclusion:

The future of vertical software in the AI era is both challenging and nuanced. On one hand, the democratization of AI tools threatens to erode the value of traditional vertical SaaS platforms, especially point solutions that rely on human-built systems and lack proprietary data advantages. The allure of building in-house AI-driven tools tailored to unique business needs is strong, as it promises cost savings and customization.

On the other hand, history suggests that outsourcing often prevails despite technological advancements that lower entry barriers. Just as businesses continue to outsource content production despite free tools like Canva, the complexity and expertise required to develop and maintain robust AI systems may push companies to rely on external software providers or emerging AI development agencies.

I’d love to hear any comments or thoughts on this as we figure out what will happen to vertical software.